Customer acquisition is becoming more and more difficult for financial marketers in this digital age. Thanks to the internet and social media, financial customers have been quite vocal and influential about the type of service that they want from their financial institutions. Their high expectations have created an increased urgency in marketers to provide the best-personalized customer experience.

A recent Salesforce report states that 79% of consumers associated the product and services provided by a company to the experience it provides. Financial marketers have now realized that they need to leverage digital channels along with offline channels to acquire new customers.

However, there are a number of digital channels to choose from. Marketers are unable to correctly decide which channels resonate well with customers and which ones do not. They also need to find the best offer or message that would lure customers to their products and services.

CDP: Deriving Valuable Insights from Customer Data

To find the right personalized message, financial marketers must understand their customers. This includes all details such as the customer’s buying habits, transactional details, online behavior, etc. All these data points need to be curated in one central location which would act as a customer information hub.

This hub can play an important role in unifying customer data from various different sources. Valuable insights can be garnered about each customer from this data. These insights can further enable financial marketers to reach out to customers with the right personalized message on their most preferred channels.

There is a dire requirement for marketers to find the right digital tool to facilitate this process of data aggregation and profile unification. The answer to this is the Customer Data Platform (CDP). A CDP can perfectly perform all the above tasks and enable marketers to attract the right customers to their business.

Customer Acquisition Strategies Using a CDP

Let’s take a look at three important customer acquisition strategies that can be performed with a CDP:

1. Delivering 1:1 Personalized Experiences

People want to feel important and customers have the same expectation from their Financial Services providers. The more they know about their customer, the better the personalization they can deliver. These customers leave digital footprints wherever they go.

Financial marketers should be smart to capture these footprints using a CDP to understand the interests and preferences of the targeted users. These insights can help financial brands in chalking out a 1:1 personalized journey for each individual customer.

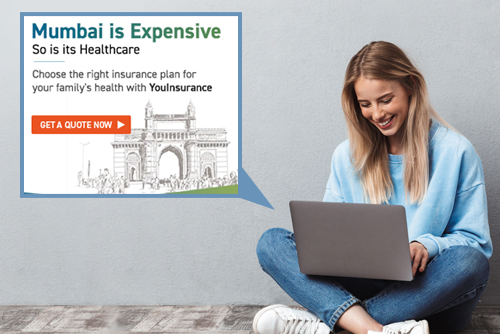

For example, a first time user visits a bank’s website from Mumbai. The location of the user can be identified from her IP address. Using this information, the bank can leverage its CDP to show personalized messages in real-time based on the user’s location. This helps in increasing user engagement and improving conversions.

2. Cross-Channel User Strategy

Enriching the user experience with an omni-digital strategy can help financial brands acquire new customers. This strategy would encompass understanding the target audience and reaching out to them with personalized consistent messaging on all channels.

A CDP will enable marketers to hit the bull’s eye by helping them provide a seamless and meaningful experience on both digital and offline channels even when the user switches from one channel to another.

For example, let’s take the case of a user who is interested in purchasing a home loan. He frequently visits the home loan page of his bank’s website. By looking at his past history through a CDP, his bank understands that his preferred channels are SMS, email, and Facebook. Using this insight, the bank sends him the same personalized home loan message on all the three preferred channels, thus enhancing his customer experience.

3. Cross-Device Strategy

A PwC study showed that 82% of 18 to 24-year-old smartphone users say that they use mobile banking. Another survey by Citigroup revealed that 91% of mobile banking users prefer banking with their app rather than going to a physical branch. All these numbers indicate the exigency for financial marketers to embrace this medium to target users with messages customized to their needs.

Convenience, ease of usage, and time-saving are the factors driving the increased usage of mobile apps for financial interactions. A CDP can facilitate cross-device personalization by delivering the same personalized message across various digital devices such as a mobile phone, laptop, tablet, etc.

For example, a user purchases life insurance from an insurance provider and drops off without submitting the required documents. Marketers can target the user with a personalized message comprising of the link. Clicking the link enables the user to upload the pending documents through a chatbot. This provides a hassle-free user experience while increasing response rates.

Conclusion

86% of consumers, according to a Salesforce report, state that they are more likely to share their user experiences if they trust a company. A Customer Data Platform provides financial marketers with enough firepower to target users with personalized experienced at every touchpoint. This not only helps in acquiring new customers but also can go a long way in building their utmost trust and loyalty.

By Gitanjali Mittal | Senior Associate Marketing at Lemnisk

Nice post. Your products and business idea can make you unique, but they cannot force the customer to trust your services.

Great insights on leveraging CDPs for customer acquisition! Essential for refining marketing strategies.

Great explanation of how CDPs can enhance customer acquisition! The insights on personalized marketing are especially valuable. Thanks for shedding light on this important tool.