When it comes to commercial banking, it is difficult to track and understand each customer’s buying propensity, behavior, and purchases. Moreover, customers (who in this case are businesses) take more time in deciding on a product/service offered by the bank. As a result, the bank’s marketers need to find a way to keep the customer engaged on the bank’s digital assets such as its website. This challenge can be solved by using a marketing technology tool that can help them in boosting digital customer engagement.

Customer Data Platform or CDP has emerged as the ideal martech tool that can help commercial banking marketers increase digital engagement, manage customer data efficiently, and target prospects and customers with personalized messages. A CDP does this by stitching together data across disparate silos and systems and generating a single unified view for each user. The unified view gives marketers valuable customer insights that enable them to devise 1:1 personalized marketing campaigns for their customers.

Delivering the right next best experience plays an important role especially for commercial bank customers. A contextually-relevant message tailored to their needs can resonate really well with them and increase their time spent on the site. It can eventually lead them to sign up for a product or schedule a meeting with the bank’s representatives.

This article focuses on 4 next best experience use cases that marketers can implement for commercial banking using a CDP:

4 Next Best Experience CDP Use Cases for Commercial Banking

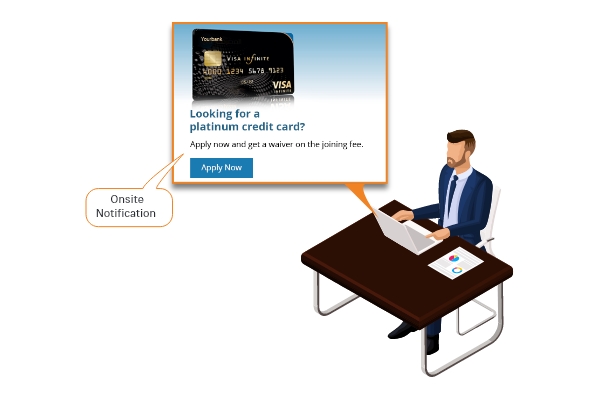

1. Product Intent

A prospective user comes to a bank’s website, visits the corporate card page, and drops off. Using the CDP, the user can be targeted with a personalized message to bring him/her back to the bank’s website.

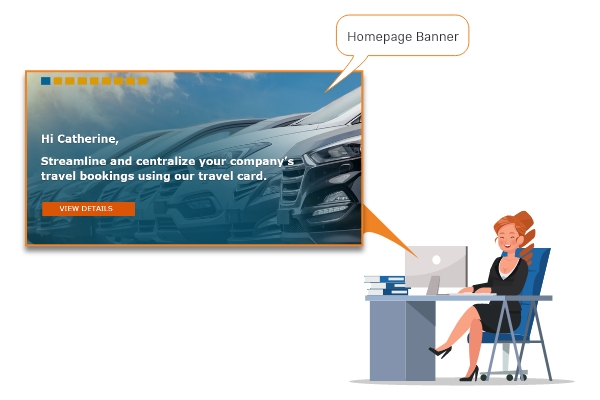

2. Cross-Sell/Up-Sell Offer

A customer who already has a corporate card can be sent a personalized cross-sell/up-sell offer to purchase another card such as a travel card.

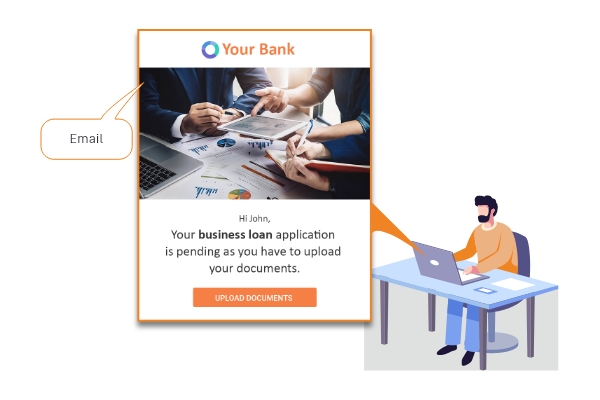

3. Pending Documentation

A customer drops off from a bank’s website without uploading the documents for his company’s business loan application. The user can be sent a personalized message asking him to complete the documentation process.

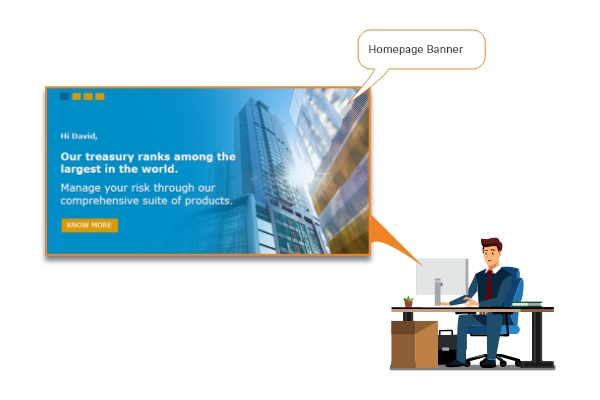

4. Offline Branch Visit

A prospect visits a bank’s branch and enquires about their foreign exchange services and shares his details. Later, when the customer visits the bank’s website, he is shown a personalized offer on the bank’s forex services.

Get a copy of this blog in the form of a free infographic.

Download Now

By Bijoy K.B | Marketing Manager at Lemnisk

Leave a Reply