This is the era of “personalization at scale”. But what does this term actually mean? In simple words, it’s the ability of a marketer to deliver 1:1 personalized experiences to thousands of customers. This implies that no two customers get the same user experience and each and every one of them gets their own personalized experience with respect to their digital activity.

The world has evolved from the point where financial companies push their products to users to the users demanding customized and tailored experiences from their service providers. There have been umpteen technologies in the market that can tackle this personalization challenge. However, for a successful outcome, financial services companies need to overcome their technological as well as business roadblocks.

The Worth of Personalization at scale

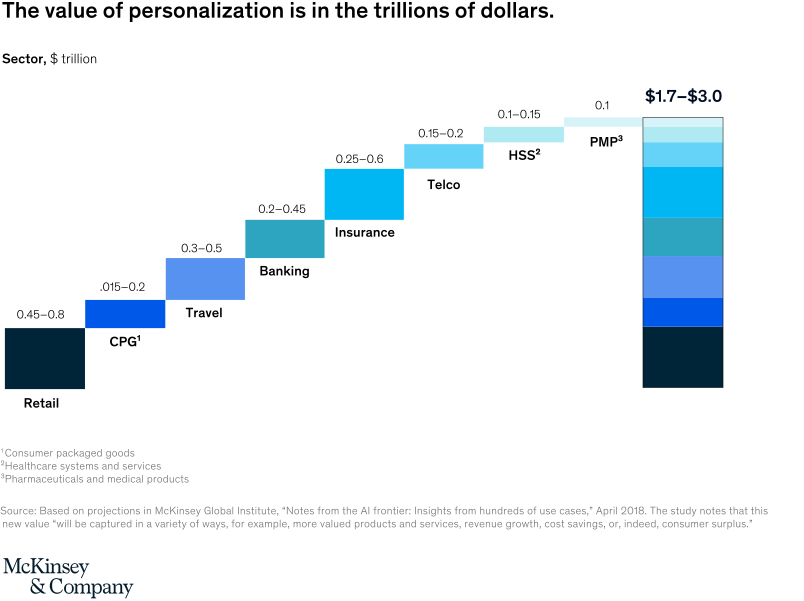

As per research by McKinsey and Company, the value generated by personalization at scale is in the range of $1.7 trillion to $3 trillion across major industries such as retail, consumer goods, travel, banking, insurance, telecom, etc.

In the above graph, if one looks at the banking and insurance sectors, the personalization value ranges from $400 to $600 billion alone. This figure indicates how serious financial marketers have become with respect to delivering personalization to their customers.

What drives Personalization?

As per Mckinsey, there are four factors that drive personalization at scale – Data, Decisioning, Design, and Distribution. Both the marketing and IT teams need to work together to chalk out a proper personalization plan around these factors.

Data

The primary factor that drives personalization is data. It is the universal panacea to a financial marketer’s personalization woes. But decoding data is another humongous task.

The problem here is that data isn’t stored in one particular location. It’s in fact kept across different sources or silos. Financial marketers need to find a way to collect data from these silos and store them in a central location. Once this is done, they need to map the data against each user. This is where the importance of identity resolution comes in.

Effectively resolving identities helps in removing duplicate and redundant data and helps in making every data accountable to a particular user. As a result, the data is now unified under a user. This helps the marketer to clearly view every digital activity of the user. Therefore, using this information, financial marketers can activate digital channels and deliver personalization to each individual user.

There are three platforms that help you achieve this – Customer Data Platform (CDP), Identity Resolution, and Data Management Platform (DMP). In recent times, new-age vendors are coming up with an all-in-one solution where the capabilities of an identity resolution platform and a DMP are embedded within a CDP.

Also Read: 7 Use Cases of a CDP for Financial Services Marketers

Decisioning

A CDP without a decisioning engine is like a human being without a brain. CDPs equipped with adequate analytic and decisioning models can create propensity scores for customers regarding their digital behavior. Financial marketers can use these scores to deduce the next best marketing action that needs to be tailored for each customer.

The use of Artificial Intelligence (AI) and machine learning have a major role to play here. Marketers can create complex algorithms that can help in extracting hidden and actionable insights from real-time data. This helps them to better optimize their marketing decisions which help them in creating consistent hyper-personalized user experiences.

Also Read: The Role of AI in Martech and its Applications in the BFSI Sector

Design

This factor talks about the different ways in which financial marketers can reach consumers. Personalization at scale demands marketers to reach millions of customers with personalized content that’s exclusive and unique to each person. Content exists in various forms such as emails, images, videos, banners, etc. These elements need to be stored in a content library and tagged for easy retrieval and usage.

A digital asset management and design platform can assist in storing this content library and help marketers test various content variations that need to be served to their users.

Distribution

Distribution is where the requirement of channel orchestration in real-time comes to play. Channel orchestration is a feature that enables financial marketers to deliver contextually-relevant marketing campaigns to customers on their most preferred digital channels and devices. A CDP helps marketers to easily identify which channels are the users engaging in and when is their engagement period the highest. Using this information, personalized messages can be delivered to users on their preferred channels at the preferred time of engagement.

To make this feature operational at scale, a CDP needs to be coupled with AI. AI algorithms are capable of delivering unique personalized messages to millions of customers. Each customer gets their own customized message at the right time and on the channels of their choice.

Also Read: How Channel Orchestration Can Enhance Customer Engagement

Conclusion

Thus, as seen above, all four factors are essential to achieve personalization at scale. The right digital platform such as an all-in-one CDP can go a long way in deciphering the mind of the consumer and help in reaching them with the right personalized messages/offers that can increase revenue as well as advocacy.

Reference: A Technology Blueprint for Personalization at Scale (McKinsey & Company)

By Bijoy K.B | Senior Associate Marketing at Lemnisk

Leave a Reply