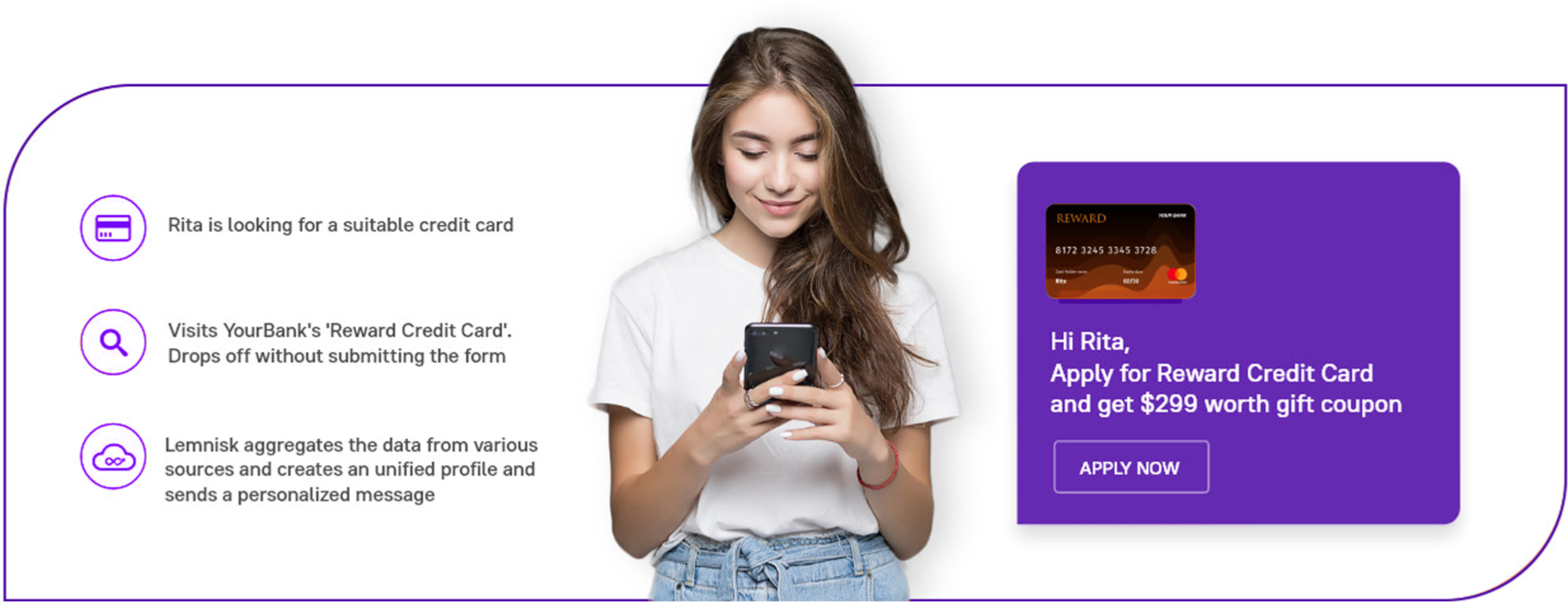

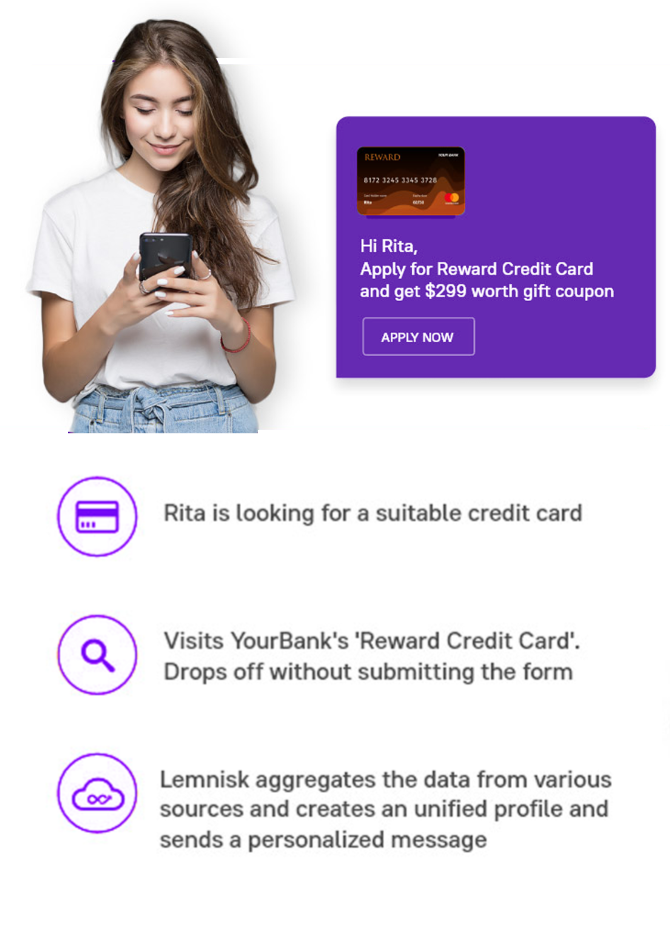

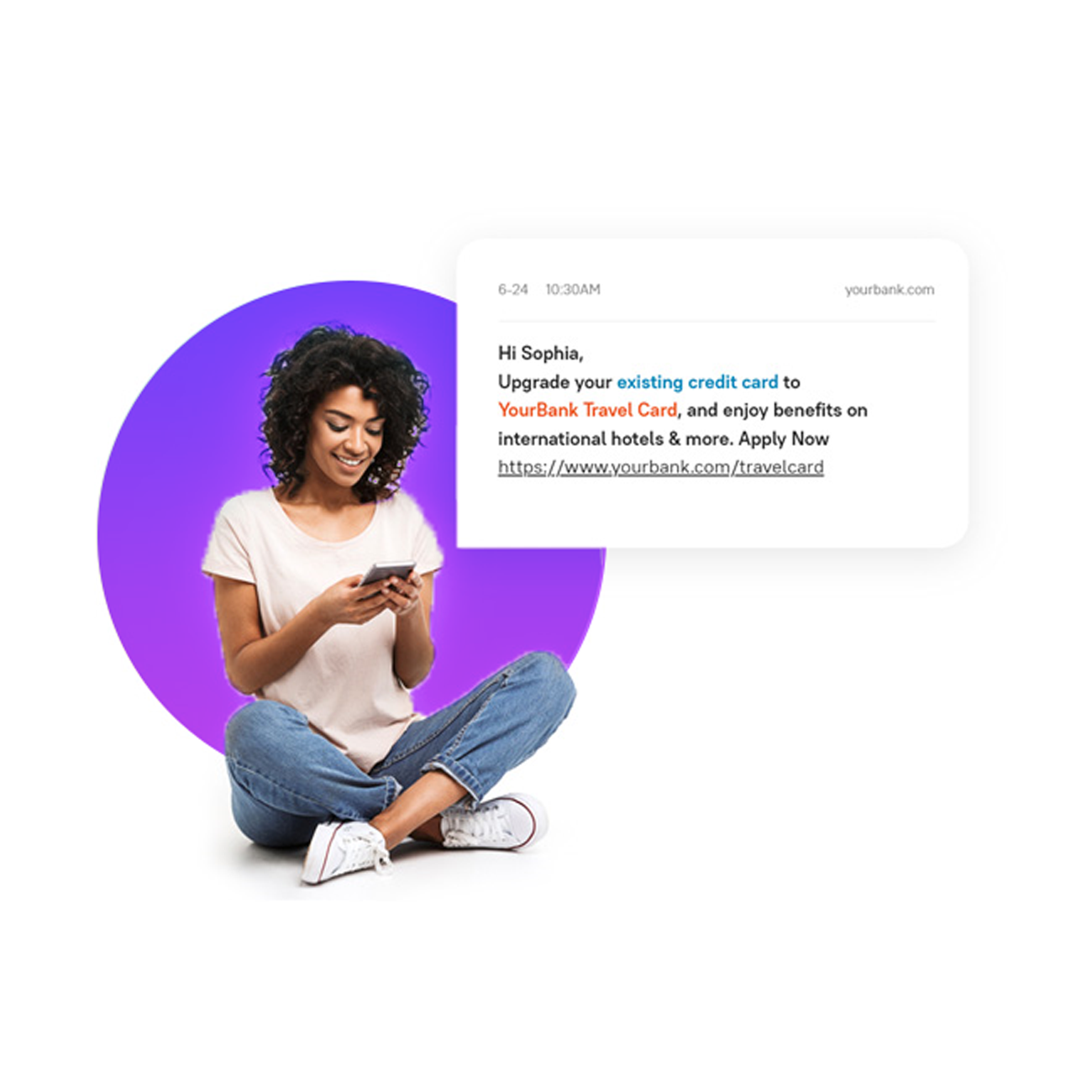

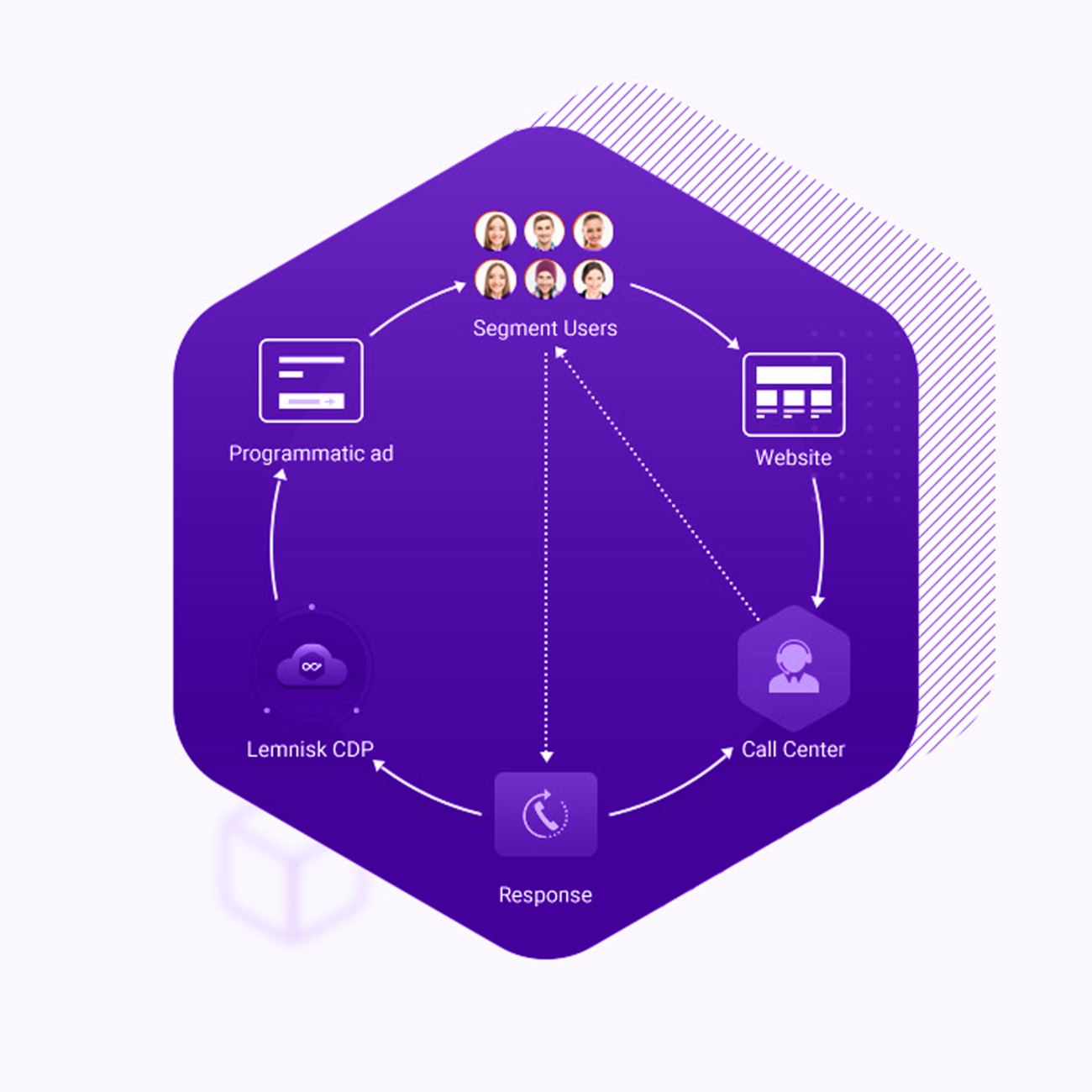

Here’s how Lemnisk helps global banks increase online user engagement

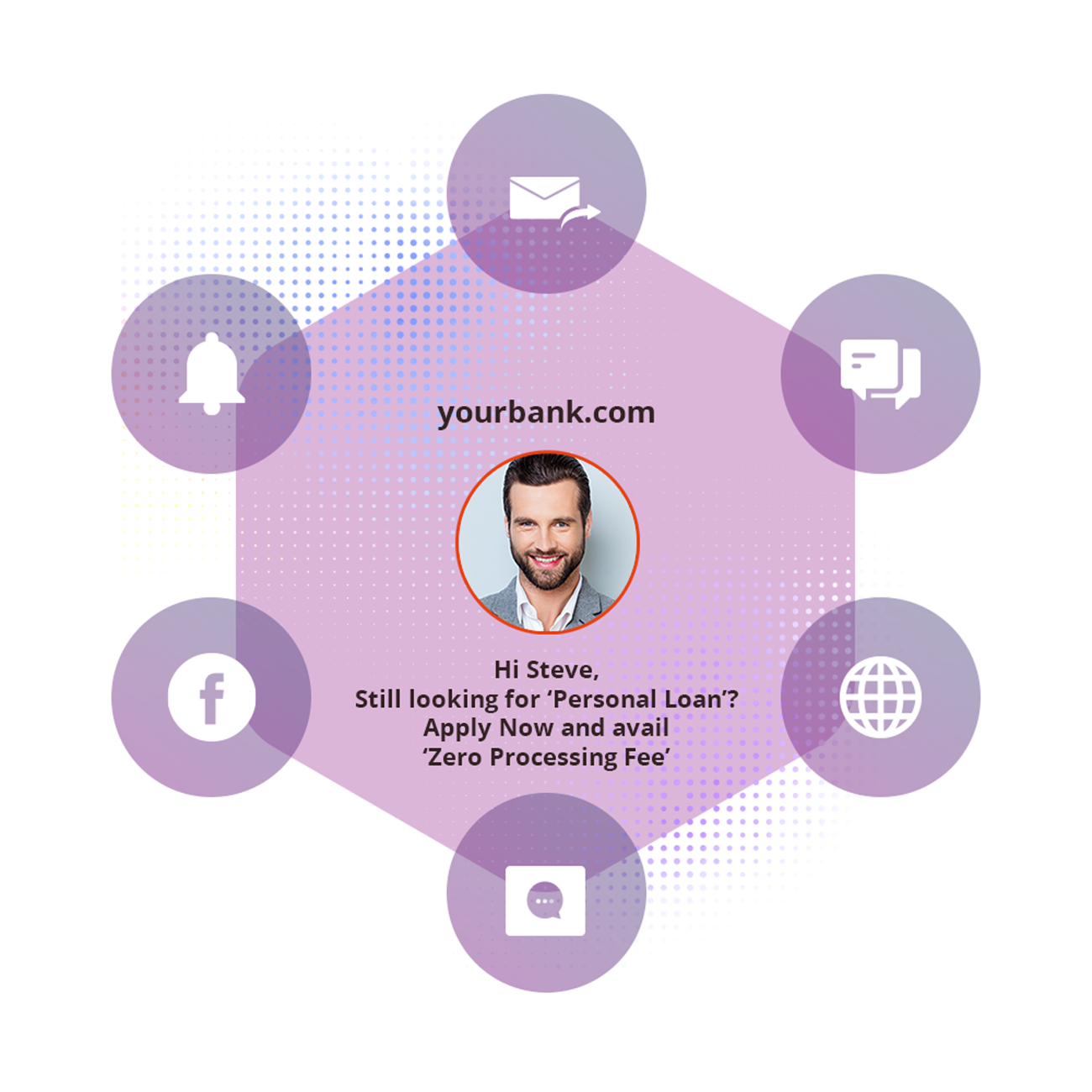

Globally, marketers in the financial services industry are under constant pressure to increase online engagement and provide a personalized customer experience across a range of marketing channels. Lemnisk’s Intelligent Customer Data Platform has helped some of the world’s leading banks to orchestrate a unique hyper-personalized customer experience across all touchpoints.